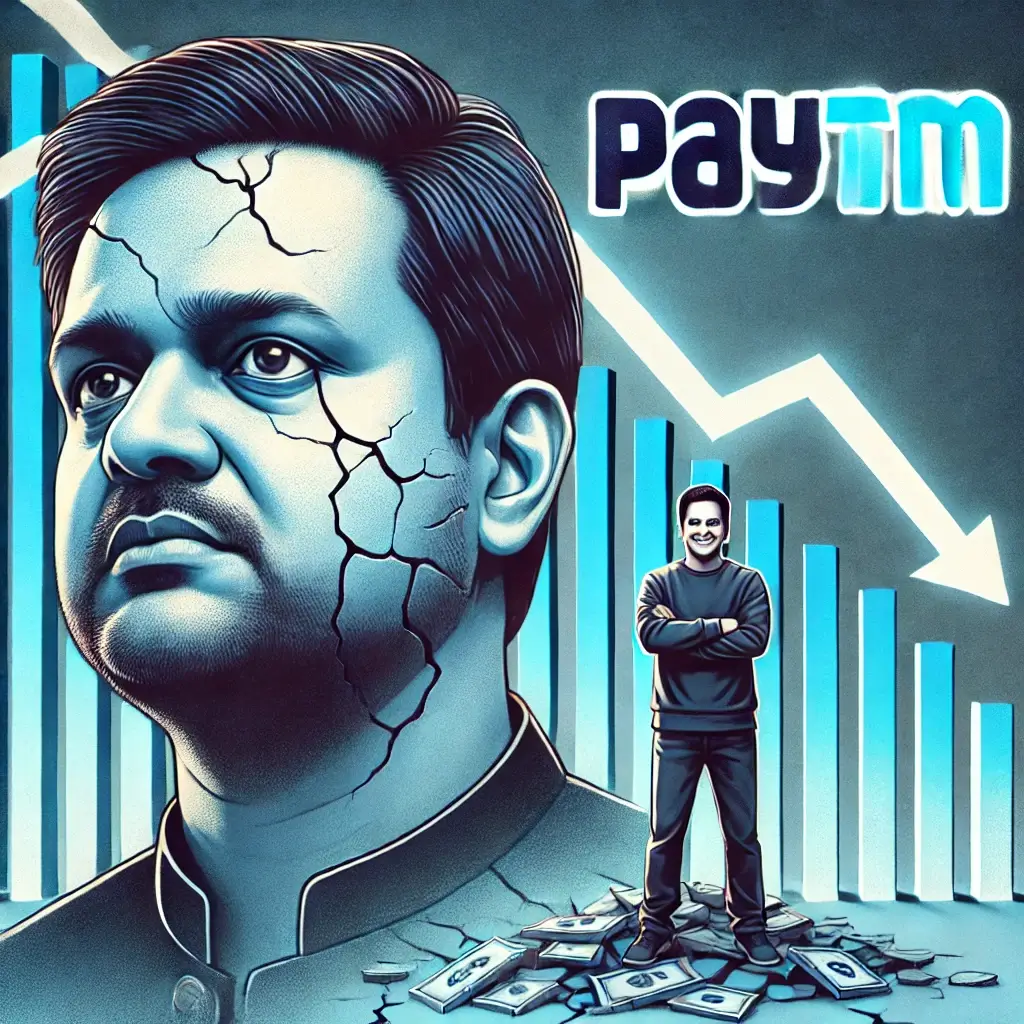

Paytm, once the leader in India’s digital payments industry, has been struggling in recent years due to regulatory actions, financial losses, and increasing competition. While competitors like PhonePe and Google Pay have gained dominance, Paytm has been losing ground.

In this article, we break down the five biggest reasons behind Paytm’s downfall and why it couldn’t keep up with its rivals.

1. What Regulatory Issues Has Paytm Faced?

One of the biggest reasons for Paytm’s struggles has been regulatory scrutiny from the Reserve Bank of India (RBI).

- RBI Ban on Paytm Payments Bank (2024):

- In January 2024, RBI restricted Paytm Payments Bank from onboarding new customers and processing deposits due to compliance violations.

- This impacted Paytm’s wallet services, UPI transactions, and FASTag operations.

- Data Security Concerns:

- RBI also raised concerns about data-sharing practices, which led to further regulatory actions.

- The restrictions severely affected user trust and merchant partnerships.

🚨 Impact: Paytm lost a significant portion of its banking services, while competitors like PhonePe and Google Pay continued growing without such restrictions.

2. Why Has Paytm Struggled with Profitability?

Despite being one of India’s most well-known fintech brands, Paytm has struggled to generate consistent profits.

- High Cash Burn Rate:

- Paytm aggressively spent on cashbacks, discounts, and marketing, leading to massive financial losses.

- In contrast, PhonePe and Google Pay offered fewer incentives but built better user retention.

- Falling Stock Prices:

- Paytm’s IPO (November 2021) was the biggest in India but crashed 70% soon after listing.

- Investors lost confidence in Paytm’s ability to scale profitably.

🚨 Impact: With ongoing financial struggles, Paytm was unable to reinvest in product innovation like its competitors.

3. Paytm vs. PhonePe vs. Google Pay: Why Couldn’t Paytm Keep Up?

Paytm lost its dominance to PhonePe and Google Pay, which now control over 80% of UPI transactions. Here’s why:

| Feature | PhonePe | Google Pay | Paytm |

|---|---|---|---|

| UPI Market Share | 📈 50%+ | 📈 35%+ | 📉 Under 15% |

| Banking Integration | Partnered with major banks | Backed by Google | Paytm Payments Bank (faced RBI bans) |

| User Trust | High | High | Low due to RBI actions |

| Merchant Network | Extensive | Strong | Declining |

| Ease of Use | Simple & Fast | Smooth Interface | Some glitches & delays |

Why Paytm Fell Behind?

- Trust Issues: Paytm faced repeated regulatory crackdowns, whereas PhonePe and Google Pay had fewer such concerns.

- UPI Market Shift: Users and merchants moved to PhonePe & Google Pay due to better reliability.

- No Strong Parent Backing:

- PhonePe is backed by Flipkart/Walmart → strong financial support.

- Google Pay is backed by Google → unlimited resources.

- Paytm lacked deep financial backing after its IPO failure.

🚨 Impact: Paytm lost its competitive edge, while its rivals captured the majority of digital transactions in India.

4. Poor Customer Experience and Trust Issues

- Frequent App Downtime & Glitches:

- Users reported failed transactions and refund delays, leading to frustration.

- Weaker Customer Support:

- Unlike Google Pay and PhonePe, Paytm’s customer service was often criticized for slow response times.

- Lack of Innovation:

- Paytm failed to introduce new features that could differentiate it from competitors.

🚨 Impact: Users switched to PhonePe and Google Pay, further reducing Paytm’s market share.

5. Failed Expansion and Business Model Issues

Paytm tried to diversify beyond payments but struggled to succeed in these areas:

- Paytm Mall (e-commerce) failed due to tough competition from Amazon & Flipkart.

- Stock Broking & Wealth Services didn’t gain enough traction.

- Movie & Event Ticketing was dominated by BookMyShow.

🚨 Impact: Unlike competitors that focused on their strengths, Paytm expanded in too many directions and failed to make any one business profitable.

Can Paytm Recover from Its Downfall?

Despite its struggles, Paytm is trying to make a comeback with these strategies:

✅ Focusing on Merchant Services – Expanding its PoS (Point of Sale) devices for offline payments.✅ Partnering with Banks – Shifting from Paytm Payments Bank to external banks for services.✅ Cost Cutting & Profitability Focus – Reducing discounts and improving operational efficiency.

🚀 However, rebuilding trust, gaining user confidence, and competing with PhonePe & Google Pay will be a long battle.

Final Thoughts: Will Paytm Survive?

Paytm’s downfall was driven by regulatory issues, poor financial performance, strong competition, and weak customer trust. While it is still trying to stay relevant, the road to recovery won’t be easy.

📌 What do you think? Can Paytm regain its lost glory? Let us know in the comments!