Looking for an easy way to apply for a Bajaj Finance Card in 2025 with instant approval? This powerful card allows you to shop for electronics, appliances, and more with flexible EMI options-all without a credit card!

In this guide, we’ll cover the step-by-step process to apply, eligibility criteria, required documents, and pro tips to get instant approval. Follow these simple steps and get your Bajaj Finance Card hassle-free today!

Step-by-Step Guide to Apply for a Bajaj Finance Card in 2025 (Instant Approval Process)

Are you looking for an easy and hassle-free way to apply for a Bajaj Finance Card in 2025 with instant approval? This comprehensive guide will take you through every step of the process, ensuring you get your Bajaj Finserv EMI Network Card quickly and start shopping with easy EMIs.

Let’s dive into the step-by-step process to apply online and activate your Bajaj Finance Card seamlessly.

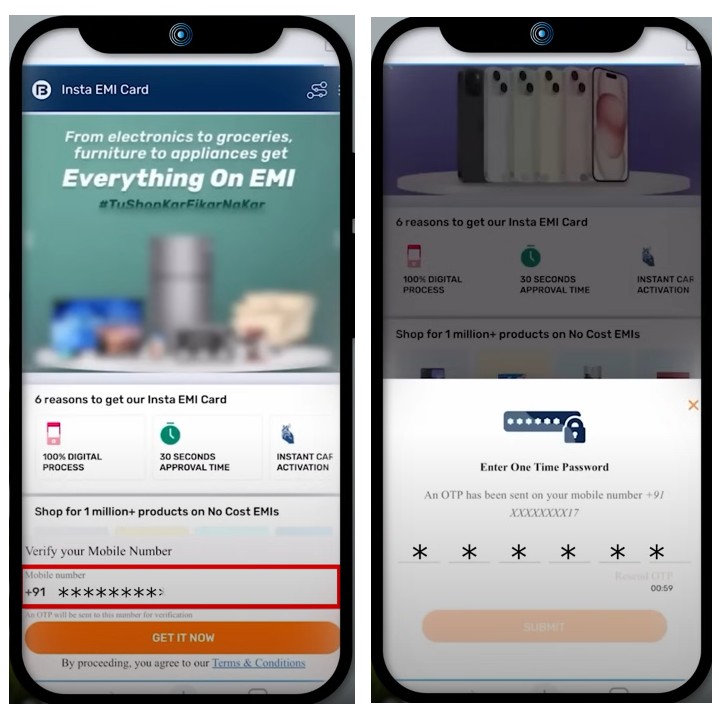

Step 1: Enter Your Mobile Number & Verify OTP

1️⃣ Visit the official Bajaj Finserv website and navigate to the EMI Card application page.

2️⃣ Enter your registered mobile number and click on “Get Now” to proceed.

3️⃣ An OTP (One-Time Password) will be sent to your mobile number.

4️⃣ Enter the OTP and click on “Submit” to verify your mobile number.

📌 Pro Tip: Ensure that your mobile number is linked to your Aadhaar card for a smooth KYC process.

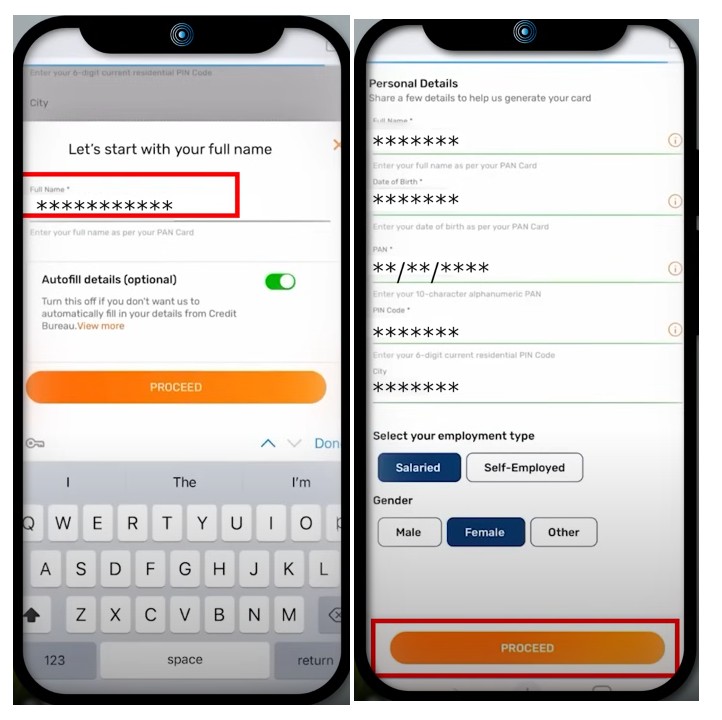

Step 2: Enter Personal Details (As Per PAN Card)

✅ Enter your full name exactly as it appears on your PAN card.

✅ Double-check the spelling to avoid any mismatch issues.

✅ Click on “Proceed” to move to the next step.

📌 Example: If your PAN card name is Rakesh Sharma, enter it exactly the same way.

Step 3: Fill in Your Basic Details

Next, you will be asked to provide some essential details:

🔹 Full Name (as per PAN Card)

🔹 Date of Birth (DD/MM/YYYY format)

🔹 PAN Card Number

🔹 Pincode & City Name

📌 Why is this required? These details help Bajaj Finserv verify your identity and determine your loan eligibility.

Step 4: Select Your Employment Type & Gender

1️⃣ Choose your employment type:

- Salaried (for employees working in private/public sectors)

- Self-Employed (for business owners, freelancers, or professionals)

2️⃣ Select your gender and click on “Proceed”.

📌 Why does employment type matter?Your income source affects your loan limit and approval speed. Salaried applicants may receive faster approvals.

Step 5: Check Your Pre-Approved Loan Limit

💰 Based on your creditworthiness, a loan limit will be assigned to you.For example:

✅ Loan Limit: ₹1,35,000 for this applicant.

✅ Maximum Limit: ₹3,00,000 (for applicants with a high CIBIL score).

📌 Tip: A higher CIBIL score (700+) increases your chances of getting a higher loan limit.

Step 6: Confirm Personal Details & Address

🔹 The system will automatically fetch your address, mobile number, and photo.

🔹 Verify if the address is correct and click on “Confirm”.

🔹 If there is an error, click on “Update Address” to make corrections.

📌 Pro Tip: Make sure your Aadhaar card address matches your current address to avoid verification delays.

Step 7: Review Card Fees & Transaction Limits

🔹 Your assigned loan limit (e.g., ₹1,35,000) will be displayed.🔹 The first offline transaction limit will be ₹50,000 (you cannot exceed this amount on your first purchase).🔹 After your first transaction, you can use the full loan limit for further purchases.

📌 Example:

- First transaction limit: ₹50,000

- Subsequent transactions: ₹1,35,000

Step 8: Pay the One-Time Fee

🔹 The system will display the joining fee (e.g., ₹530).🔹 Click on “Proceed” to make the payment.🔹 Choose your preferred payment method:✅ UPI (Google Pay, PhonePe, Paytm, etc.)✅ Net Banking✅ Debit Card

📌 Tip: Using UPI for payment is quick and convenient.

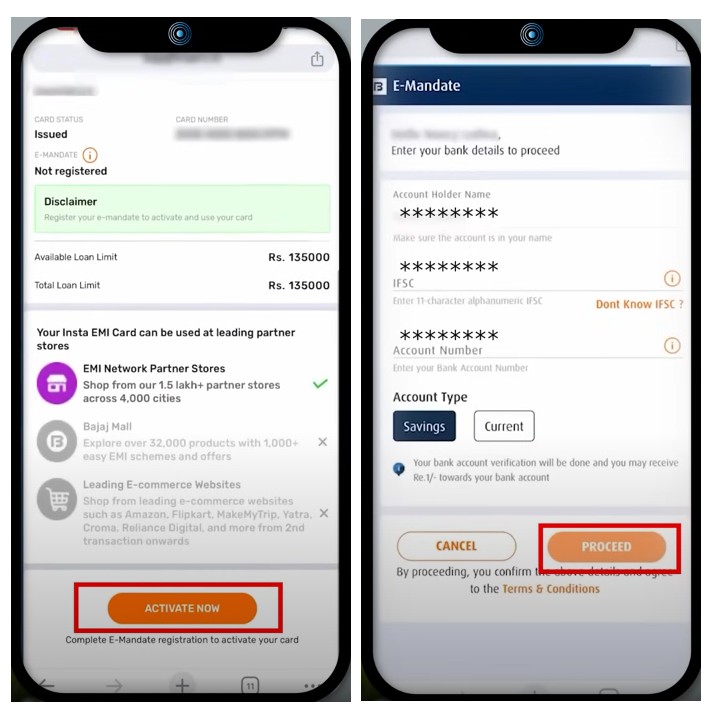

Step 9: View & Activate Your Bajaj Finance Card

🔹 Once payment is completed, your Bajaj Finserv EMI Network Card will be generated.🔹 Your card number will be displayed, but it will be masked for security.🔹 Click on “View” to reveal the card details.

📌 Important:

- An OTP will be sent for security verification.

- Enter the OTP and click on “Submit” to access your full card details.

Step 10: Set Up E-Mandate for EMI Payments

🔹 To make your EMI payments hassle-free, you need to set up an E-Mandate (auto-debit from your savings account).

🔹 Follow these steps to link your bank account:1️⃣ Enter your bank account holder name.2️⃣ Enter your IFSC code and bank account number.3️⃣ Choose your account type (Savings or Current).4️⃣ Click on “Proceed” to link your account.

📌 Example: If your bank is ICICI Bank, you will receive a confirmation message showing your account details.

🔹 The E-Mandate limit is set based on your loan amount (e.g., ₹25,000 auto-debit limit).🔹 Select the checkbox to agree to the terms and click “Generate OTP”.🔹 Enter the OTP sent to your registered mobile number and click “Validate OTP”.

✅ Once the OTP is verified, your E-Mandate setup is complete!

Step 11: Final Activation & Using Your Bajaj Finance Card

🔹 Your Bajaj Finance Card is now activated! 🎉🔹 Click on “View Card” to check the card details.

🔹 Next step:

- Install the Bajaj Finserv App from the Google Play Store or Apple App Store.

- Log in to the app and find your EMI Card on the home screen.

- Click on “EMI Card” to view your details.

📌 Pro Tip: Your first transaction must be done offline before using the card for online purchases.

How to Use Your Bajaj Finance Card?

🔹 Offline Shopping: Use the EMI Card at partner stores like Croma, Vijay Sales, and Reliance Digital.🔹 Online Shopping: After your first offline purchase, use the card on platforms like Flipkart, Amazon, and Bajaj Mall.🔹 Healthcare & Education: Pay medical bills or tuition fees using easy EMIs.

Congratulations! 🎉 You have successfully applied for the Bajaj Finserv EMI Network Card and can now enjoy no-cost EMIs on various products.

By following these steps, you can ensure instant approval and start shopping without financial stress. 🚀

FAQs

🔹 Can I apply without a credit score?Yes! A credit score is not mandatory, but having a CIBIL score of 700+ improves approval chances.

🔹 How long does approval take?If all details are correct, approval is instant, and your card is activated within minutes.

🔹 What is the joining fee?A one-time joining fee (e.g., ₹530) applies.

🔹 Can I increase my loan limit later?Yes, with a good repayment history, Bajaj Finserv may increase your credit limit over time.

📢 Now that you know how to apply for a Bajaj Finance Card in 2025, why wait? Apply now and enjoy easy EMIs on your favorite products! 🚀