Looking for a zero balance savings account with hassle-free online account opening? Bank of Baroda (BOB) offers a Zero Balance Savings Account, allowing you to enjoy banking benefits without worrying about maintaining a minimum balance.

With BOB online account opening, you can instantly open an account from the comfort of your home using your Aadhaar and PAN card. This account is ideal for students, salaried individuals, and anyone looking for a simple digital banking solution.

In this guide, we’ll walk you through the step-by-step process to open a Bank of Baroda zero balance account online, its benefits, eligibility, required documents, and why it is one of the best zero balance accounts in India.

BOB Zero Balance Account Types: Which One is Best for You?

Bank of Baroda offers two types of zero balance savings accounts:

- BOB Bro Account

- BOB Lite Account

Both of these are zero balance savings accounts, but there are some key differences you should know before opening an account. Choosing the wrong one might lead to unwanted charges later.

In this guide, we will explain:✅ The differences between BOB Bro Account and BOB Lite Account✅ Which account is best for you?✅ How to open a Bank of Baroda zero balance account online?

Understanding these details will help you avoid unnecessary charges and choose the right account based on your needs. 🚀

How to Open a Zero Balance Savings Account in Bank of Baroda (BOB)

Hello friends! In this guide, I will walk you through the step-by-step process of opening a zero balance savings account with Bank of Baroda (BOB).

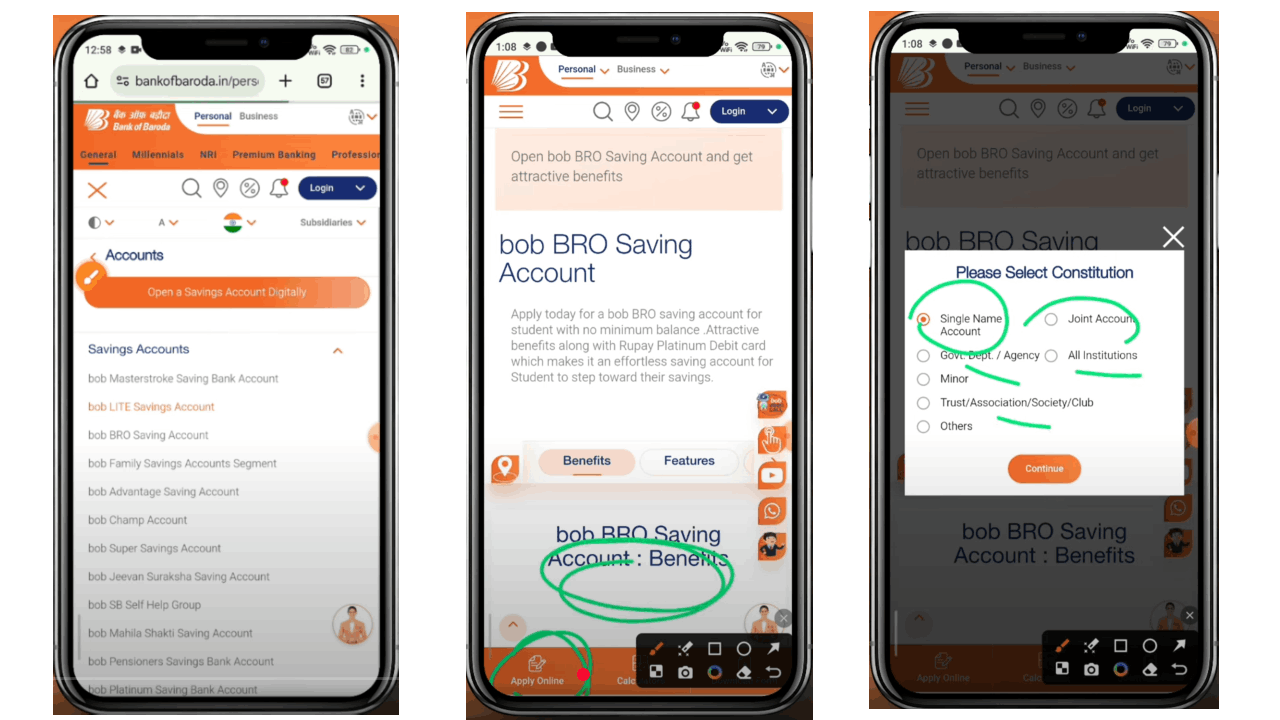

Step 1: Accessing the Account Opening Option

- On the top left corner of the screen, click on the three-line menu.

- From the menu, select “Accounts” and then choose “Savings Accounts”.

- Here, you will see multiple savings account options, but we will focus on the BOB Lite Savings Account and BOB Bro Savings Account-both of which offer a zero-balance feature.

Step 2: Understanding the Differences Between BOB Lite & BOB Bro Accounts

BOB Lite Savings Account:

- Zero balance account – No need to maintain a minimum balance.

- Free banking services – NEFT, RTGS, IMPS, and UPI transactions are free.

- Debit Card Charges – If you want a physical Rupay Platinum Debit Card, you must maintain a quarterly average balance:

- ₹3,000 for Metro Cities

- ₹2,000 for Urban Areas

- ₹1,000 for Semi-Urban & Rural Areas

- If the balance requirement is not met, an annual debit card fee of ₹199 will be charged.

BOB Bro Savings Account:

- Zero balance account – No minimum balance required.

- Lifetime free Rupay Platinum Debit Card – No issuance or annual charges.

- Free banking services – NEFT, RTGS, IMPS, and UPI transactions are free.

- Free Chequebook – 25-page chequebook free every year. Additional chequebooks can be issued for a nominal charge.

- Free SMS Alerts – No hidden charges.

- Demat Account Benefits – Up to 100% concessions on charges.

Step 3: Who Can Open These Accounts?

- BOB Lite Account: Available for individuals aged 18+, including students, salaried employees, and self-employed persons.

- BOB Bro Account: Available for individuals aged 10 to 25 years. If you turn 25, the account automatically upgrades to a regular savings account without requiring an application.

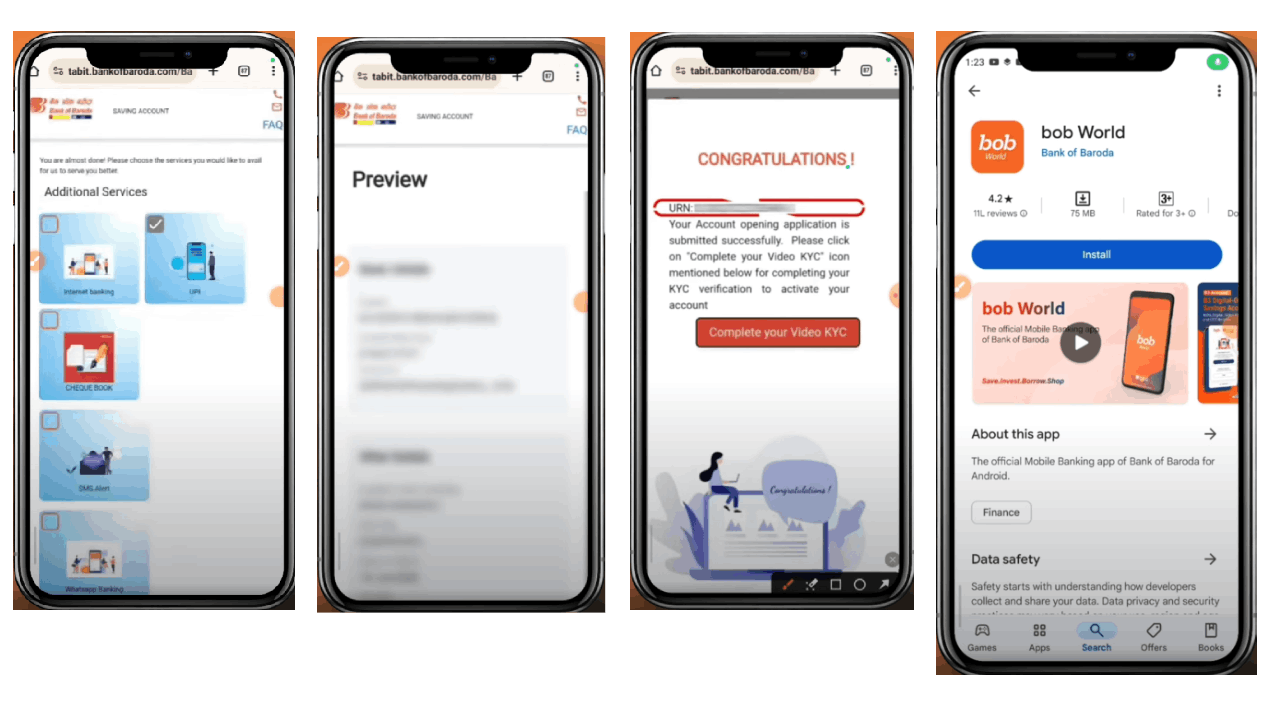

Step 4: How to Apply Online for a BOB Bro Savings Account

To open a BOB Bro Savings Account, follow these steps:

- Click on the official link .

- You will be redirected to the BOB Bro Savings Account page.

- Scroll down and click on “Apply Online”.

- Choose the account type (Single Name Account).

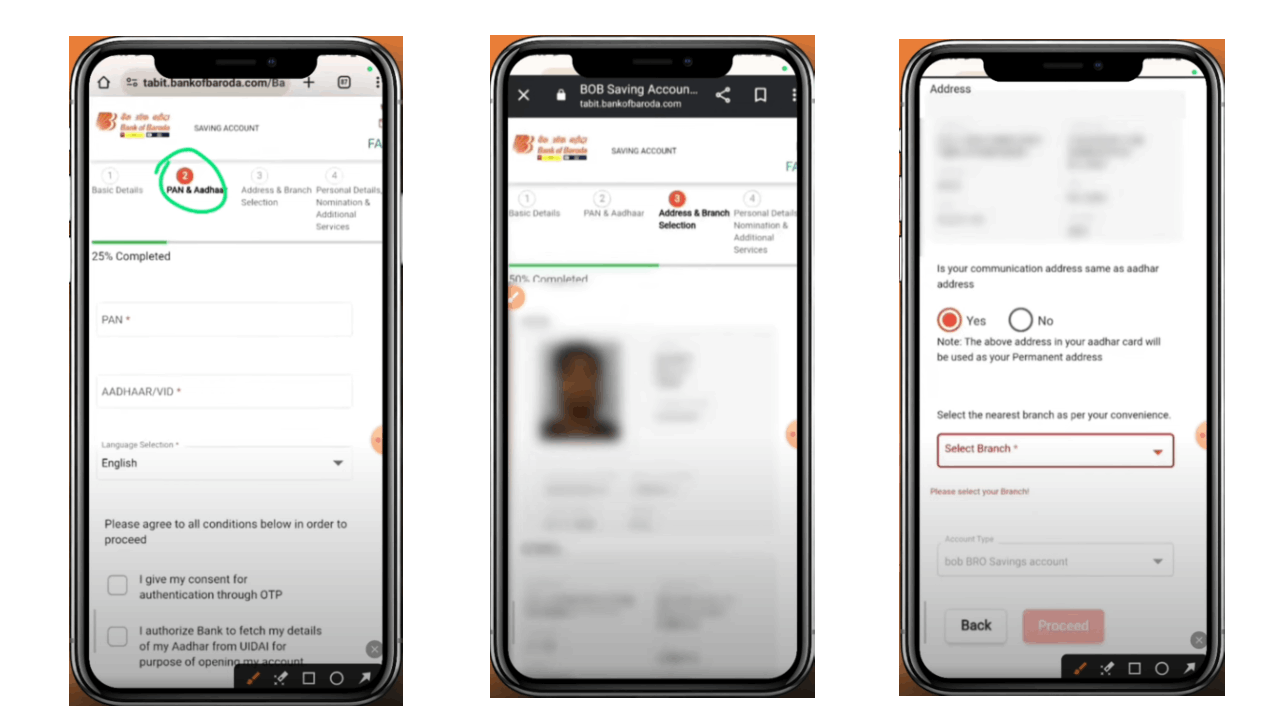

- Documents Required: Only Aadhaar Card & PAN Card.

- Your Aadhaar-linked mobile number and an email ID are required for registration.

- Select your preferred language (English or Hindi).

- Enter your mobile number and verify it with OTP.

- Fill in your PAN and Aadhaar details.

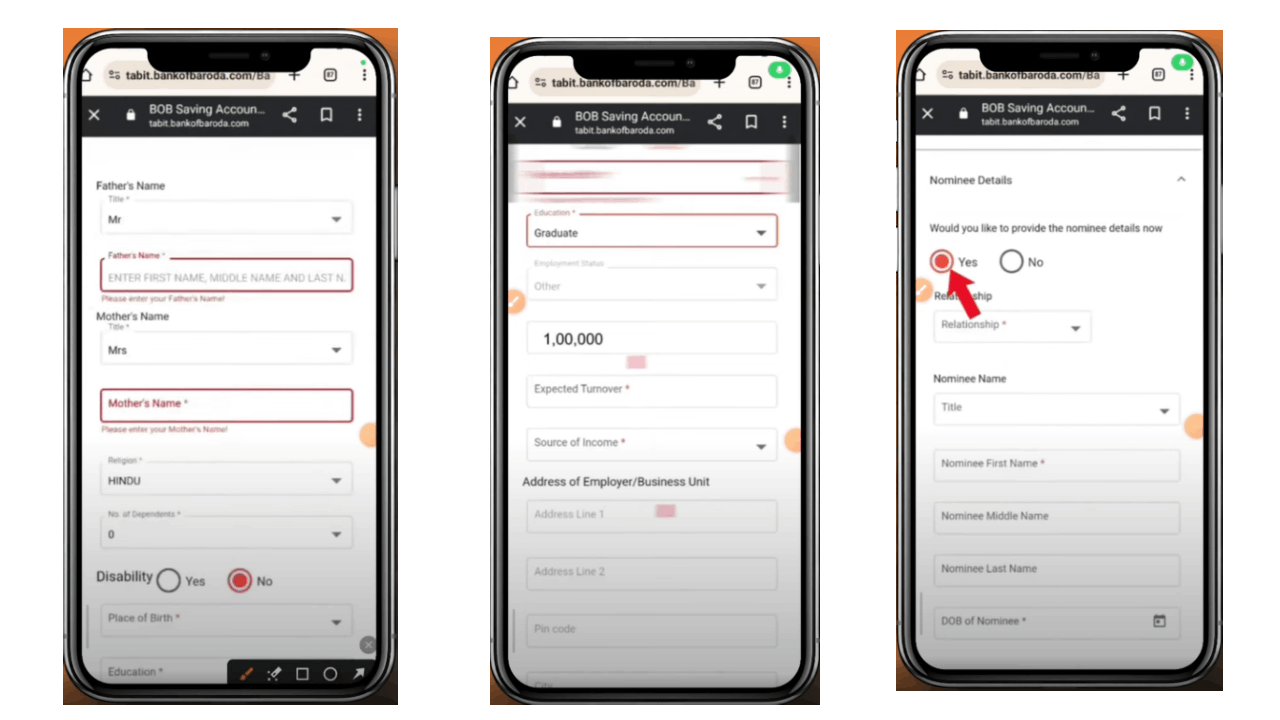

- Confirm your Aadhaar-based personal details (name, father’s name, address, etc.).

- Select your nearest Bank of Baroda branch.

- Provide details of your parents and nominee (optional but recommended).

- Complete the application process and submit your request.

How to Complete Video KYC for Bank of Baroda Online

To activate your Bank of Baroda zero balance savings account, you need to complete the Video KYC (Know Your Customer) process. Follow the step-by-step guide below to complete your verification successfully.

Step 1: Click on “Complete Your Video KYC”

- Log in to the Bank of Baroda online account opening portal.

- Click on “Complete Your Video KYC” option.

Step 2: Grant Required Permissions

Before proceeding, make sure to:✔️ Keep your original PAN card and Aadhaar card handy.✔️ Have a blank paper and a pen ready, as you’ll need to provide a live signature.

Next, allow the required permissions for your camera and microphone.

Step 3: Connect with a Bank Agent

Once you grant permissions:

- A Bank of Baroda representative will connect with you via video call.

- The Video KYC process will begin.

Step 4: Verification Process

During the video call, the bank agent will:✅ Ask basic questions, such as your full name and PAN card number.✅ Request you to show your PAN card via your back camera.✅ Ask you to sign on paper and display it for verification.✅ Confirm your identity by asking a few security questions.

Step 5: Video KYC Completion

Once all the details are verified, your Video KYC will be successfully completed, and your account activation process will move forward.

👉 Complete your Video KYC today and enjoy hassle-free banking with Bank of Baroda!