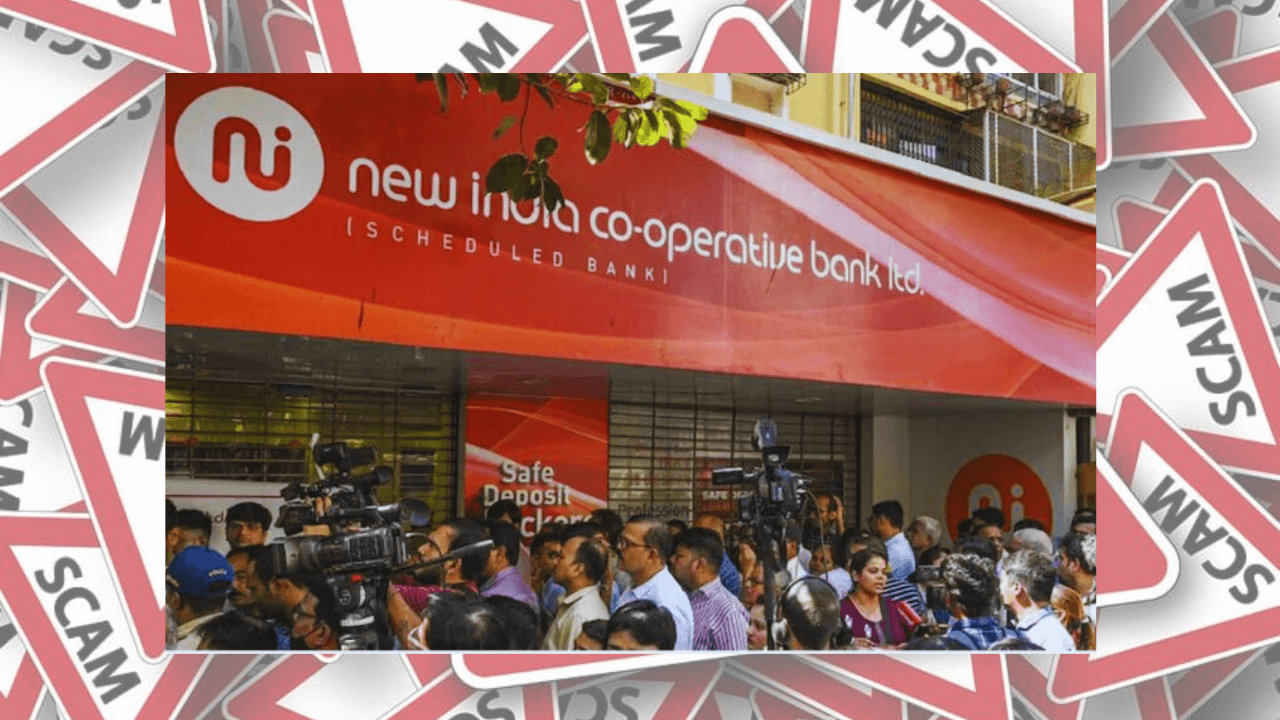

New India Cooperative Bank Scam: Everything You Need to Know

The New India Cooperative Bank scam has left thousands of investors and depositors in distress. With ₹122 crore missing from its vaults and the Reserve Bank of India (RBI) stepping in, the situation has raised serious concerns about banking frauds in India. This article explains what actually happened, how depositors can recover their money, the role of unsecured loans, and the future of the bank.

What Happened in the New India Cooperative Bank Scam?

- Discovery of Missing Funds: In February 2025, the RBI conducted an inspection and found that ₹122 crore was missing from the bank’s vaults in Mumbai’s Prabhadevi and Goregaon branches.

- Prime Accused: Hitesh Mehta, the bank’s former General Manager, allegedly misused his position to withdraw cash and provide unsecured loans to individuals, including:

- Dharmesh Paun (Real Estate Developer) – ₹70 crore

- Unnathan Arunachalam (alias Arunbhai) – ₹40 crore (currently absconding)

- Illegal Transactions: Instead of depositing the money back, these funds were misappropriated, causing financial instability in the bank.

Why Did This Happen?

- Lack of Oversight: Internal audits and regulatory checks failed to detect fraudulent withdrawals.

- Unsecured Loans: The bank disbursed large sums without proper collateral, leading to financial risk.

- Mismanagement: The accused exploited loopholes in bank operations over several years.

What Actions Has RBI Taken?

- The RBI superseded the bank’s board and appointed an administrator.

- Depositor withdrawals have been restricted until further notice.

- Legal action is underway against those involved in the fraud.

Can Investors & Depositors Recover Their Money?

- Deposit Insurance Scheme:

- Under DICGC (Deposit Insurance and Credit Guarantee Corporation), depositors are insured for up to ₹5 lakh per account.

- If the bank goes under liquidation, insured deposits will be refunded.

- Government Intervention:

- The Indian government is considering increasing the deposit insurance limit to help affected customers.

- Loan Recovery:

- Authorities are tracing the assets of the accused to recover the missing funds.

What Happens Next?

- The bank may undergo restructuring or merger with another bank to stabilize operations.

- The investigation is ongoing, and more arrests could follow.

- Depositors are advised to stay updated via RBI and official bank notifications.

The New India Cooperative Bank scam is a wake-up call for depositors to be cautious about where they invest their money. While the RBI is taking steps to recover the funds and protect depositors, legal proceedings could take time. Investors should keep track of official updates and explore options for financial security.