How to Transfer Money from Credit Card to Savings Account for Free

Friends, now you can easily transfer money from your credit card to your savings account using a secure and reliable method. Many applications facilitate this process, but most charge a transaction fee ranging from 1% to 3%. For example, if you transfer Rs. 1 lakh using an app that charges a 3% fee, you will pay Rs. 3,000 extra. However, today we will discuss an application that allows you to transfer money from your credit card to your savings account free of cost. This method ensures secure transactions without additional fees.

Which App Allows Free Transfers?

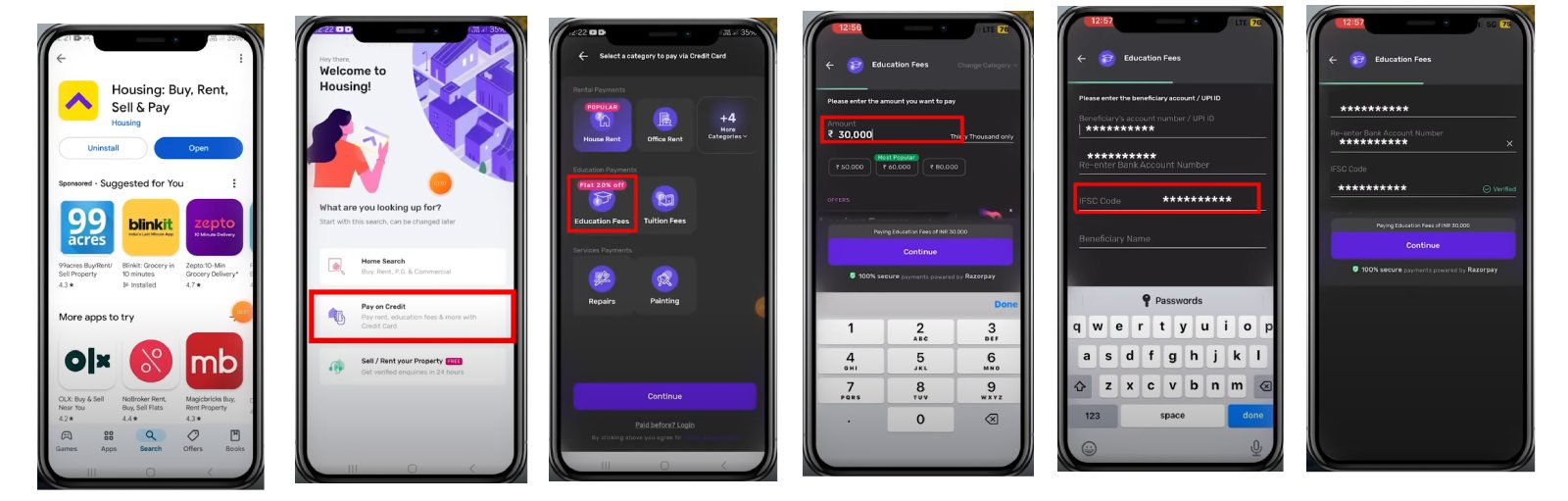

The application you need to install is ‘Housing, Buy Rent, Sell and Pay’, available on both the Google Play Store and App Store. Let’s go through the step-by-step process.

Step-by-Step Process to Transfer Money

-

- Install and Open the App: Download and install ‘Housing, Buy Rent, Sell and Pay.’

- Allow Basic Permissions: Grant the necessary permissions.

- Select ‘Pay on Credit’: The main menu has options such as ‘Home Search,’ ‘Pay on Credit,’ and ‘Sell or Buy Property.’ Click on ‘Pay on Credit.’

- Choose a Transfer Reason: The app will ask for a reason for the transfer. Select ‘Education Fees’ to avoid penalty fees imposed by some credit card providers on house rent payments.

- Enter the Amount: The minimum transfer amount is Rs. 1,000, and the maximum is Rs. 5 lakh. To maximize benefits, transfer a larger amount initially, as the first few transactions are free.

- Enter Beneficiary Details:

- Account number (enter twice to confirm accuracy)

- IFSC code

- Name of the beneficiary

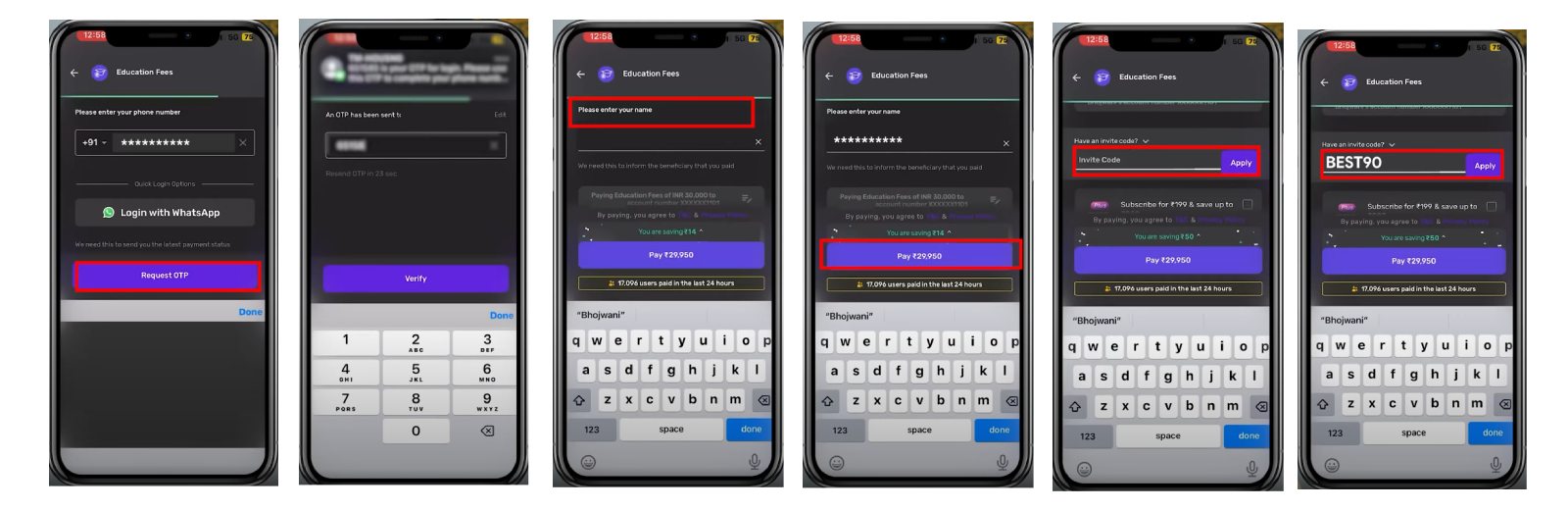

- Verify Mobile Number: Enter your mobile number and request an OTP for verification.

- Enter Invite Code for Discount: Use the invite code ‘Best90’ to get a discount.

- Final Payment Details:

-

- You will see an option to ‘Pay Rs. 29,746’ (for a Rs. 30,000 transfer).

- Without the invite code, the fee would be 1.84%.

- With the invite code, the fee is 0.99%.

-

- Complete the Transaction:

-

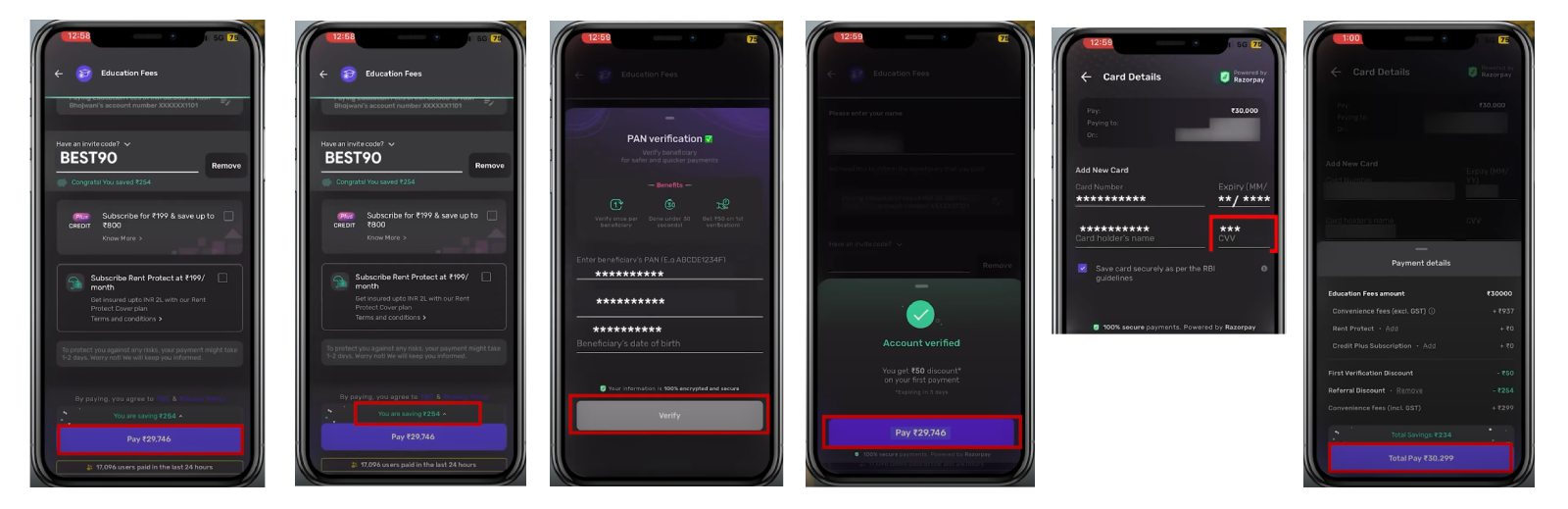

- Click ‘Pay Rs. 30,299’ (including a refundable charge of Rs. 299).

- Enter credit card details (card number, expiry date, CVV, and cardholder name).

- Complete PAN card verification for the savings account holder.

- Enter OTP for final confirmation.

-

How is the Transfer Free?

- Instant Discount: Using the invite code, you save Rs. 254.

- Cashback: Rs. 299 is returned to your Housing App Wallet after completing the transaction.

- Effective Cost: The first transaction becomes completely free because you get back the extra Rs. 299 paid.

What About Future Transactions?

- After the first free transaction, the app may start charging fees like other applications.

- Wallet cashback (Rs. 314 in this case) can be used for future transactions.

How Long Does the Transfer Take?

- 95% of transactions are completed within 24 hours.

- In rare cases (4-5%), it may take 2-4 days.

- There is no need to panic if the transfer is delayed-it will be credited to your savings account.

Using this method, your first transaction is 100% free, making it one of the best choices for transferring money from your credit card to your savings account. However, subsequent transactions may incur charges. If you found this guide helpful, please share it with others. Stay tuned for more tips and tricks! Thank you for reading!