In today’s digital age, UCO Bank is revolutionizing banking by offering an online account opening process that is simple, fast, and entirely zero balance. If you are looking for a convenient way to manage your finances without the burden of maintaining a minimum balance, UCO Bank’s online account opening service is the ideal solution for you.

What is UCO Bank Online Account Opening?

UCO Bank’s online account opening allows customers to open a savings account from the comfort of their home without visiting a branch. This service is especially popular in 2025 due to its user-friendly interface, quick processing times, and the benefit of a zero balance requirement. With just basic KYC documents, such as your Aadhaar and PAN card, you can complete the application process online.

How Does a Zero Balance Account Benefit You?

A zero balance account offers flexibility by eliminating the need to maintain a minimum balance. This feature is particularly useful for students, young professionals, and those who prefer a cost-effective banking solution. UCO Bank’s zero balance account ensures that you avoid penalty charges and can focus on managing your money efficiently.

Eligibility Criteria for UCO Bank Online Account Opening

UCO Bank has streamlined its eligibility criteria to make the process accessible to a broad range of customers. Generally, the applicant should be an Indian resident, 18 years or older, and possess valid identification documents such as Aadhaar and PAN cards. The process is designed to be hassle-free, even for those with minimal documentation.

Documents Required for Account Opening

To open a UCO Bank account online, you will need:

- A valid Aadhaar card

- PAN card

- Recent passport-sized photograph

- Proof of address (such as a utility bill or rental agreement)

Ensuring that all documents are ready before you begin the online application will help you complete the process quickly.

Key Features of the UCO Bank Online Account

UCO Bank offers a range of features that make its online account attractive:

- Zero Balance Requirement: No need to worry about maintaining a minimum balance.

- Instant Approval: Quick processing with minimal documentation.

- User-Friendly Interface: Easy navigation through the UCO Bank website or mobile app.

- Secure Transactions: Advanced security protocols ensure your data is safe.

- Comprehensive Banking Services: Access to a variety of banking services, including fund transfers, bill payments, and digital wallets.

Step-by-Step Guide to Opening Your UCO Bank Account Online

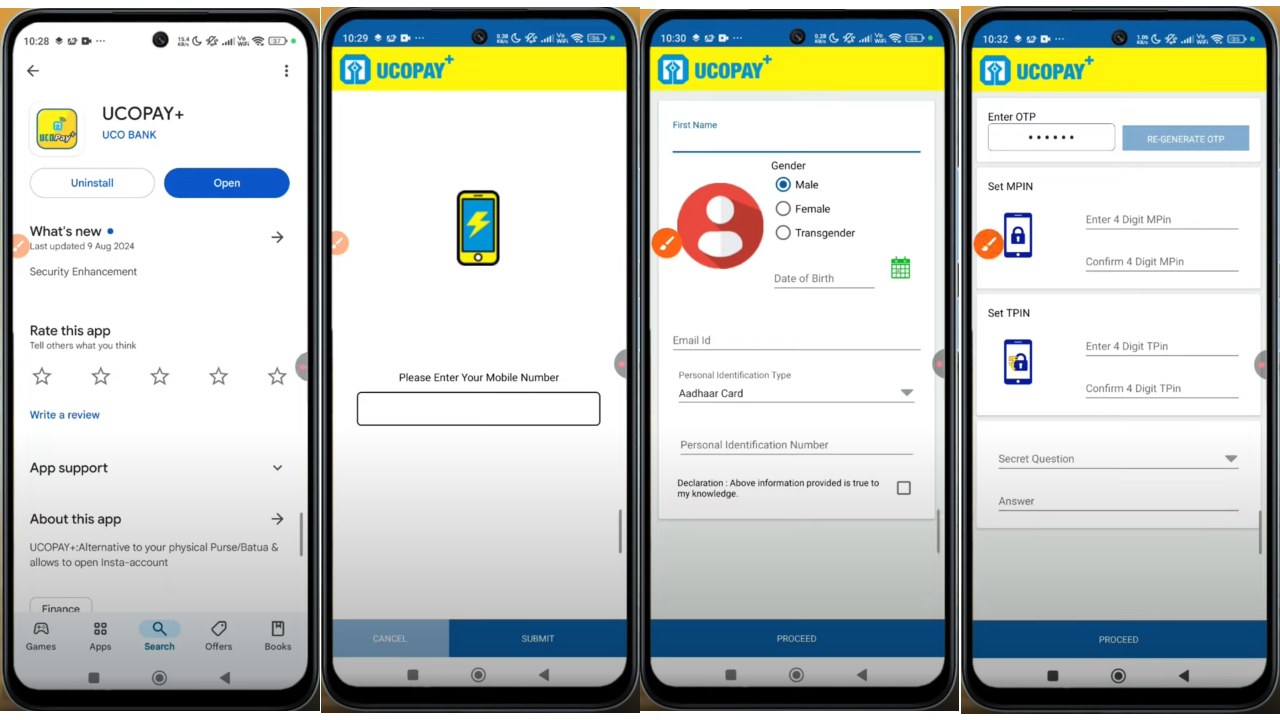

- Download the UCO Bank app or visit the official UCO Bank website.

- Enter your Aadhaar-registered mobile number.

- Input the OTP received on your mobile, set your MPIN and TPIN, then click on the “Proceed” button.

- Fill in your personal details by entering your full name, selecting your gender, adding your date of birth, and providing your email address.

- Select Aadhaar as your preferred identification proof and enter your Aadhaar number.

- Accept the declaration and click on “Proceed” to complete your application.

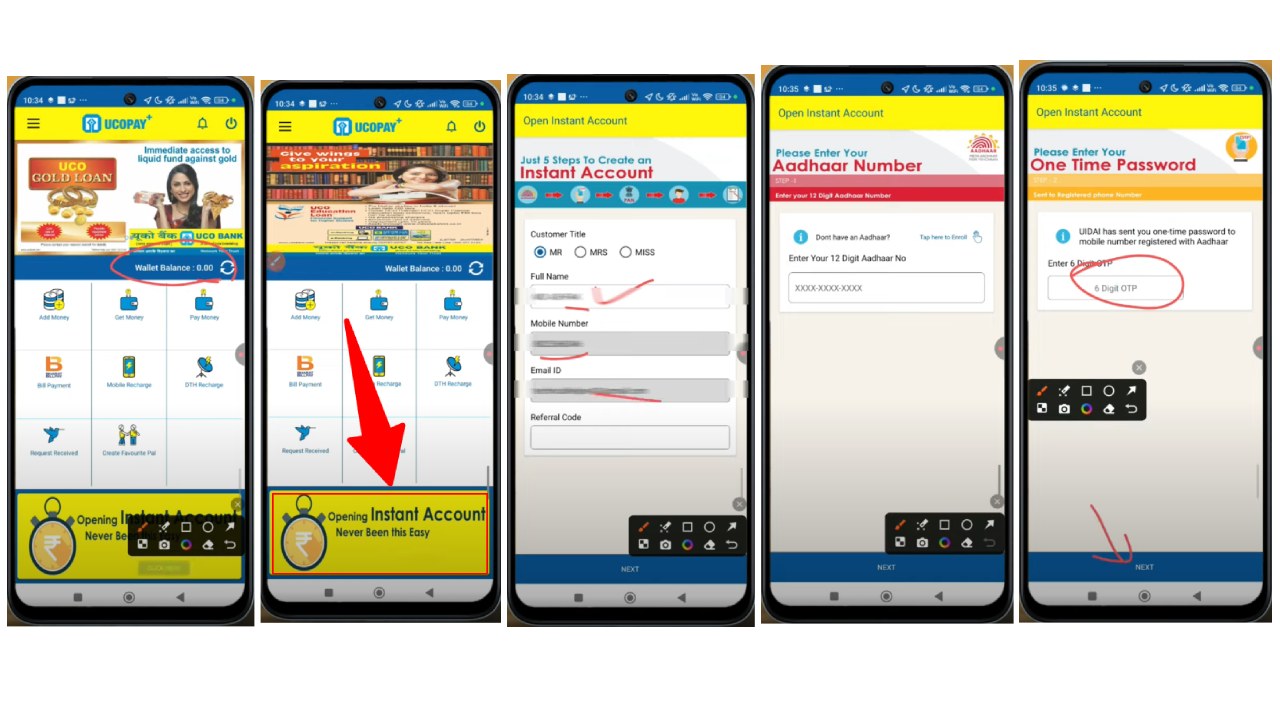

- Verify that your wallet balance displays 0.00.

- Scroll down and click on the “Opening Instant Account” yellow patch.

- Enter your personal details including your name, mobile number, and email address. If you have a referral code, fill it in; otherwise, leave it blank.

- Input your 12-digit Aadhaar number.

- Enter the OTP sent to your registered mobile number.

- Click on the “Next” button to proceed.

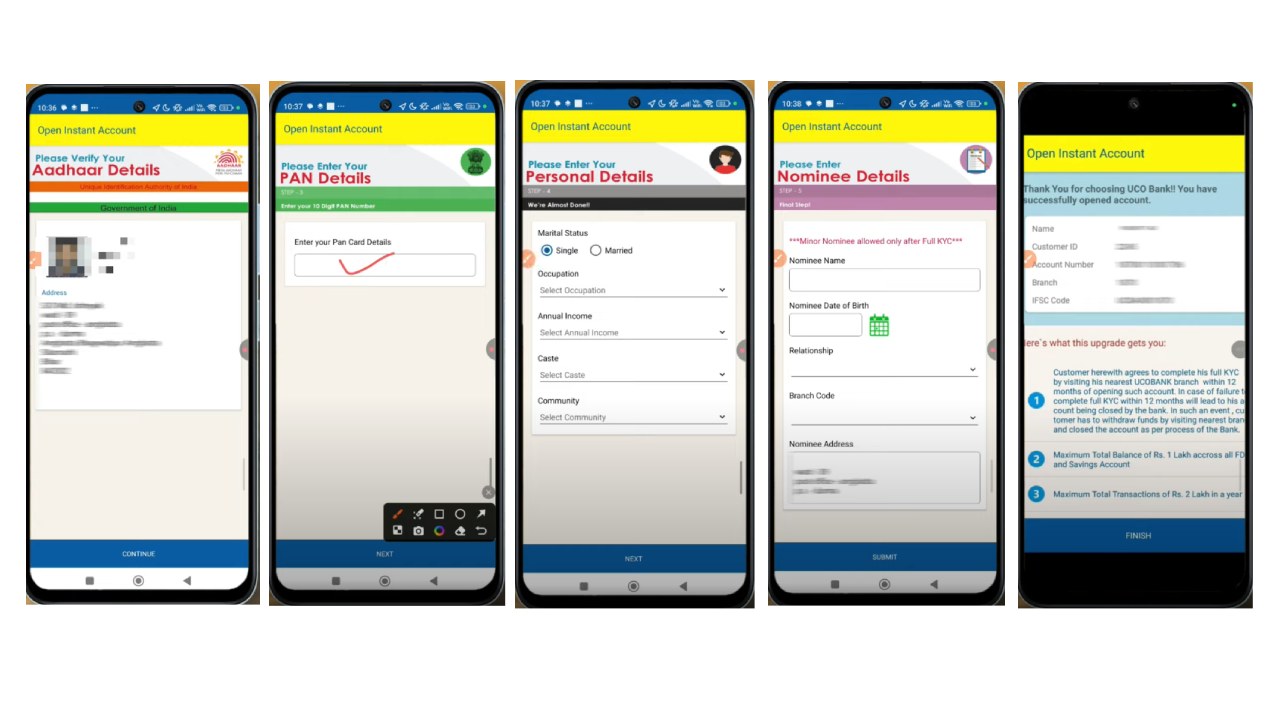

- As you can see your Aadhar details fetched.

- Now enter PAN card details.

- Enter your personal details including your Occupation, Annual Income, Cast and Community.

- Enter your Nominee Details

- Click on the “Submit” button to proceed.

- Now You can see Your UCO Bank ZERO Balance account is open.

- Click on the “Finish” button to proceed.

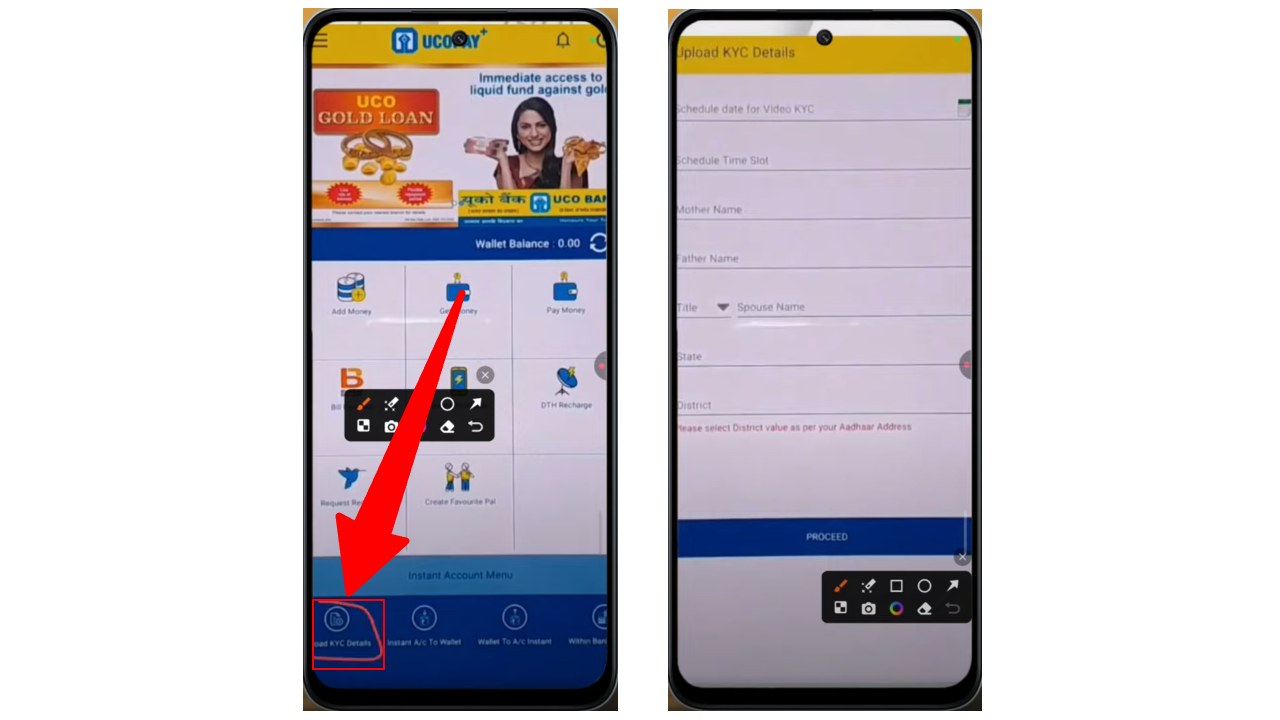

- Go Below and click on KYC details tab.

- Upload your KYC details this is last step after proceed Your Account is ready to use.